You’ve waited patiently for your college acceptance letters. Next come the financial award letters.

They will likely play a huge role in helping you choose your college. Why? Each school’s letter ultimately reveals how much aid you are eligible to receive and how much you’ll need to borrow or pay out of pocket.

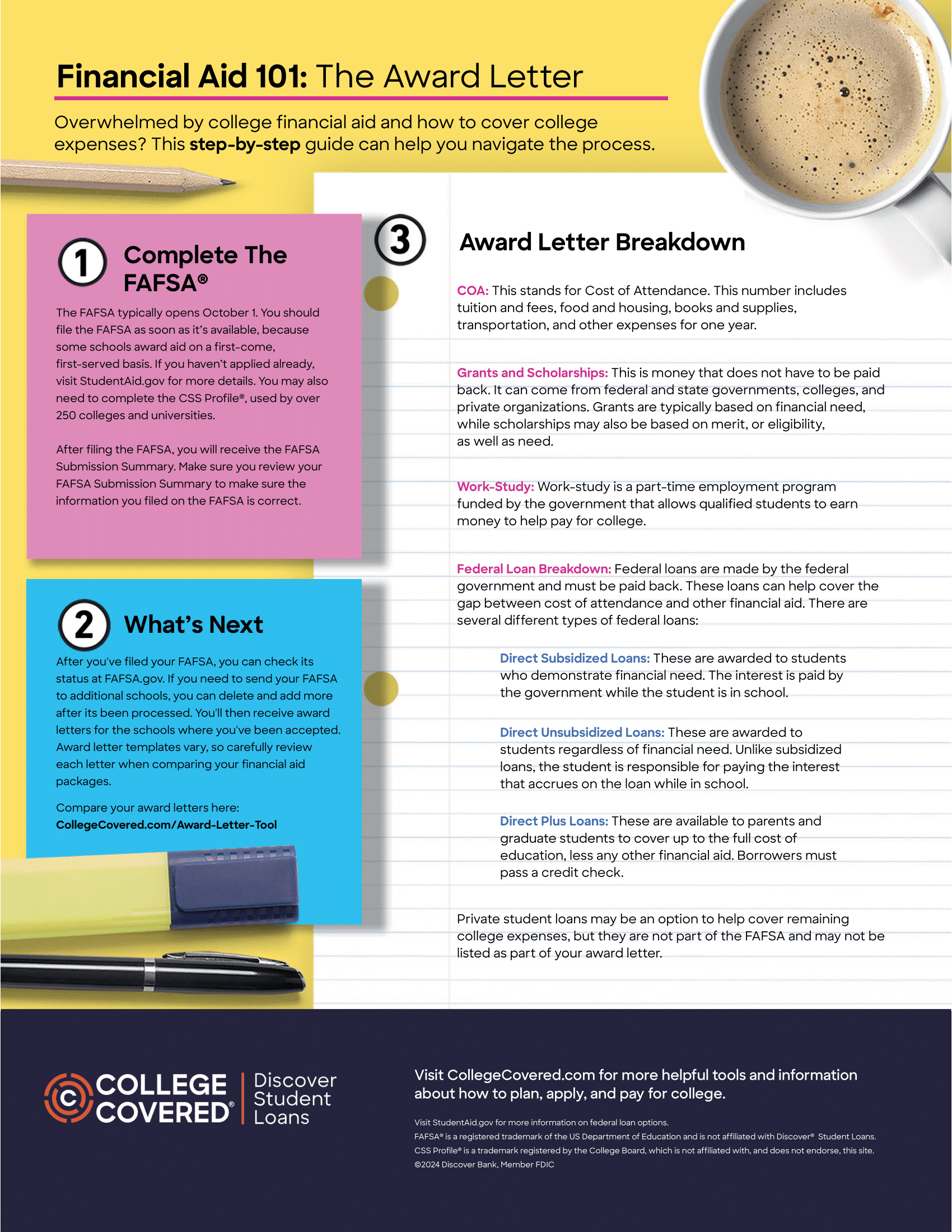

But don’t worry, we’ve compiled answers to the most frequently asked questions and a simple one sheet guide to help you decipher your financial aid award letters.

What Is in the Financial Aid Award Letter?

Your financial aid award letter, sometimes called your financial aid package, outlines the amount of financial aid you are eligible to receive from the school. It breaks down the total Cost of Attendance (COA); the amount of financial aid offered in the form of grants, scholarships, work-study, and federal loans; and the Student Aid Index (SAI), formally known as the Expected Family Contribution (EFC).

What Is COA?

COA includes tuition and fees; on-campus room and board; and books, supplies and transportation. Additional line items like loan fees, dependent care, computer purchases, and eligible study-abroad program costs may also be included. Each school has its own formula for calculating its total COA.

What Is SAI?

SAI is the number that schools use to calculate the amount of financial aid you are eligible for. It is based on the information you provided on the FAFSA® (Free Application for Federal Student Aid), and you first receive your SAI in your FAFSA Submission Summary, which was previously called the Student Aid Report (SAR).

What Is Considered Financial Aid?

Financial aid is a broad term, but it can be broken into scholarships, grants, work-study, and federal loans. Grants are a type of aid that does not have to be repaid, and the Federal Work-Study program allows students to earn income toward their financial expenses through part-time work. Federal aid can be need-based, which means that financial need is considered for determining who is eligible and for how much. There are also some types of non-need-based federal aid as well, including the Direct Unsubsidized Loan and the Federal PLUS Loan programs. Other types of aid, like some scholarships, can be merit-based, in which recipients are chosen based on factors like their talents and grades. Some scholarships factor in both financial need and merit when determining eligibility.

How Can I Compare Financial Aid Award Letters If They Look So Different?

It’s true that each school’s award letter could have a unique format. However, once you figure out the COA and the amount of aid offered for each school, you can get a sense of which one will cost you more.

Use this free online tool to compare figures side-by-side so you know how much each school costs. Keep in mind that you must apply for financial aid each year you are in school, and aid may vary from year to year.

Can I Negotiate My Financial Aid Packages?

If you are unhappy with your financial aid package or need more money to attend, you may be able to negotiate with the school. If your financial situation has changed since you filed the FAFSA, there are options to appeal your award. For instance, if your family has had a recent medical hardship, a job loss, or a death in the family, it’s important to let schools know since these may affect your ability to pay for college.

Once you’ve received all of your financial aid award letters, look them over carefully, and don’t hesitate to contact the schools if you’re confused or have questions. Having a clear sense of your financial obligations will help you determine which college is the right choice for you.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.