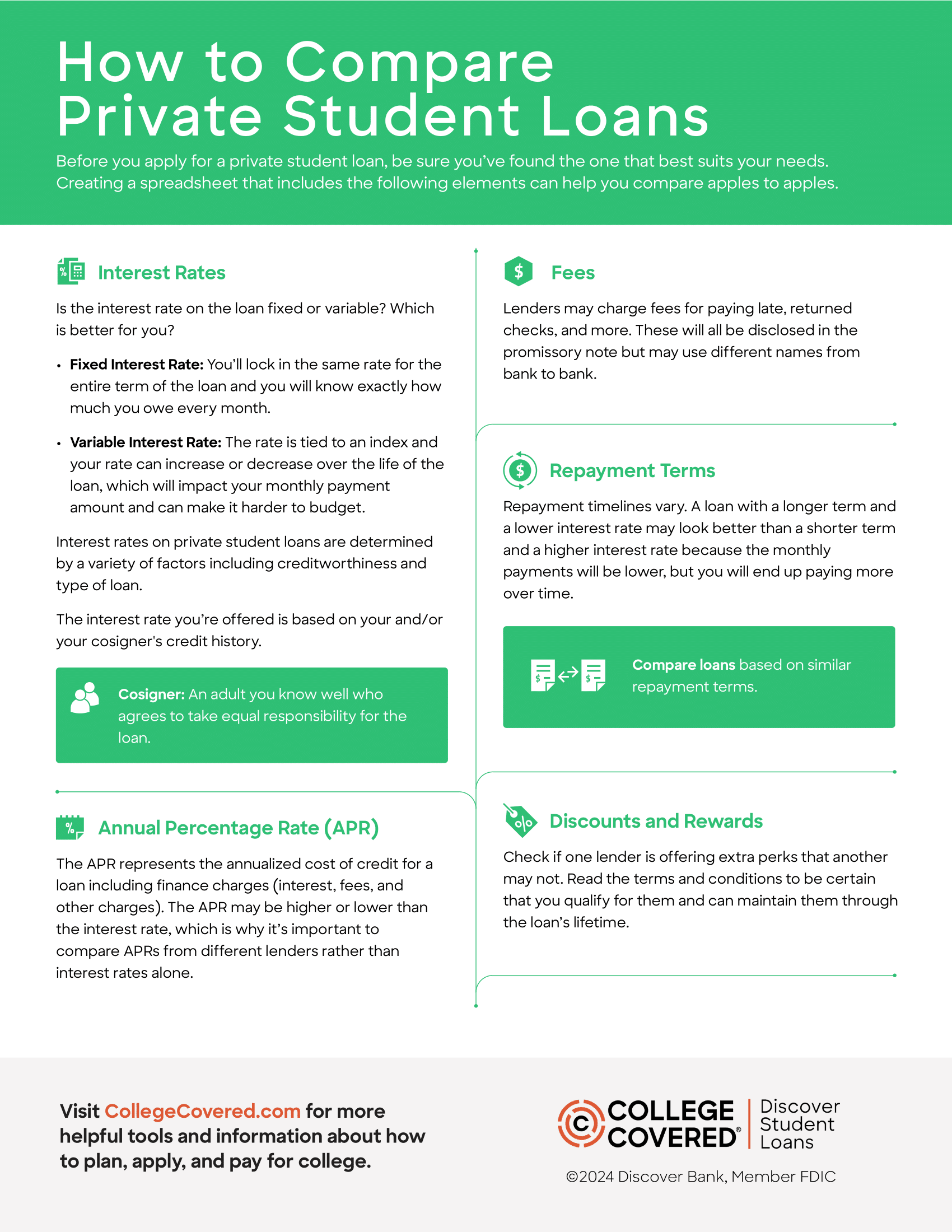

If you’ve factored in your grants, scholarships, savings, and federal student loans and still have a gap to cover in your college expenses, you may be considering a private student loan. Before you apply, be sure to evaluate these key components:

- Interest rates

- Fees

- Repayment terms

- Discounts and rewards

“I recommend creating a spreadsheet of your options, so you can make sure you’re comparing apples to apples,” says Joseph Orsolini, former chapter president of the Independent Accountants Association of Illinois and cofounder of College Aid Planners.

Interest Rates

The first factor to consider is whether the interest rate is fixed or variable. A loan with a fixed interest rate means you’ll lock in the same rate for the entire term of the loan and you will know exactly how much you owe every month. A loan with a variable interest rate is tied to an index, and your rate can increase or decrease over the life of the loan when the index changes. While the interest rate may be lower today, it could change, which will impact your monthly payment amount and can make it harder to budget.

Once you’ve determined the right type of interest rate for you, you want the lowest rate you can get. Interest rates on private student loans are determined by a variety of factors including creditworthiness. Another thing to look at is the annual percentage rate (APR) of the loan. The APR represents the annualized cost of credit for a loan including finance charges (interest, fees, and other charges). The APR may be higher or lower than the interest rate, which is why it’s important to compare APRs from different lenders rather than interest rates alone as you assess which loan is right for you.

If you’re like most high school students, you may not have an established credit history yet. This could make it difficult to be approved for a loan on your own and you may need to apply with a creditworthy cosigner. “A cosigner is a way to become a more worthy borrower because someone who has good credit is tied to the loan,” says certified financial planner and student loan consultant Lauryn Williams, founder of Worth Winning. “You also need to understand that the cosigner is on the hook for the loan. This means if you can’t make payments, the cosigner will be responsible.

Fees

Through the Truth In Lending Act (TILA), private student loan lenders are required by law to provide a clear breakdown of the loan. This includes finance charges, the total number of payments, the total amount of the loan, and any applicable fees. “The breakdown can look like a really boring document that will overwhelm you, but don’t let it. Look for the area that talks about all the various fees and home in on that,” says Williams.

Repayment Terms

Repayment timelines vary from loan to loan. While you can choose to make payments while you’re still in school, the customary grace period is six months after graduation or enrollment drops below half-time. Be certain that you’re comparing loans based on similar repayment terms: “Make sure you’re not comparing a 15-year loan to a 10-year one,” says Williams “You wouldn’t want to compare a loan with a longer term and a lower interest rate to a loan with a shorter repayment period and a higher interest rate,” she says. “Because, over time, what happens is the longer it takes you to pay your loan back, the more it costs you. So a 15-year loan is going to look better than a 10-year loan from a payment perspective because it’s going to be more affordable on a monthly basis, but you end up paying more over time.”

Discounts and Rewards

After you’ve carefully considered the rates, terms, and fees, check if one lender is offering extra perks that another may not. For instance, most lenders offer interest rate reductions for automatic payments. Read the terms and conditions of these discounts and rewards carefully to be certain that you qualify for them and can maintain them through the lifetime of your private loan. “Just make sure you’re not paying the price for these discounts elsewhere in terms of higher interest or more fees,” says Orsolini. “Look at the loan on its own and add these in after the fact, like a cherry on top.”

Bottom line: Read the fine print very closely. Borrowing for college is a long-term commitment so you should be clear on exactly what you’re signing up for. If you find that you’re not sure about something, don’t hesitate to reach out to lenders for answers to any questions you may have.